Line of Credit

Business owners can benefit from purchasing a credit line as it gives them access to a stream of capital to help with cash flow, operational expenses, and additional costs that come with running a business. There are different kinds of Credit Lines that business owners can acquire.

A Business Line of Credit is a determined credit limit that is extended to the borrower.

Advantages of Credit Line

Business Credit Lines are good for flexible Premier Assistant needs, and for businesses that experience known cash flow fluctuations due to seasonality or contract based earnings. If you operate a business that doesn’t have a steady stream of revenue you may want to consider purchasing a Business Line of Credit.

How does it work?

Business Credit Lines are good for flexible Premier Assistant needs, and for businesses that experience known cash flow fluctuations due to seasonality or contract based earnings. If you operate a business that doesn’t have a steady stream of revenue you may want to consider purchasing a Business Line of Credit.

Unsecured Line of Credit

Unsecured Lines of Credit afford you higher amounts and do not require any collateral. The product does include additional costs, shorter terms, and potentially higher interest rates.

Revolving Line of Credit

You can take funds from the credit account which will be considered against your balance as frequently as you desire, but permitted up to a defined limit. Monthly payments are required after borrowing from your line to payback the account balance. You are still able to borrow additional funds with an outstanding balance as long as you have not met the limit. Individual withdrawals have the same loan terms and is treated as a singular loan.

How does it work?

You can borrow up to the max limit of the business credit line you have been approved to use

You will only pay interest on the amount of funds drawn from the line of credit

You will be able to tap into the business credit as long as you don’t exceed the credit limit and succeed

Line of Credit

Business owners can benefit from purchasing a credit line as it gives them access to a stream of capital to help with cash flow, operational expenses, and additional costs that come with running a business. There are different kinds of Credit Lines that business owners can acquire.

A Business Line of Credit is a determined credit limit that is extended to the borrower.

Advantages of Credit Line

Business Credit Lines are good for flexible Premier Assistant needs, and for businesses that experience known cash flow fluctuations due to seasonality or contract based earnings. If you operate a business that doesn’t have a steady stream of revenue you may want to consider purchasing a Business Line of Credit.

How does it work?

Business Credit Lines are good for flexible Premier Assistant needs, and for businesses that experience known cash flow fluctuations due to seasonality or contract based earnings. If you operate a business that doesn’t have a steady stream of revenue you may want to consider purchasing a Business Line of Credit.

Unsecured Line of Credit

Unsecured Lines of Credit afford you higher amounts and do not require any collateral. The product does include additional costs, shorter terms, and potentially higher interest rates.

Revolving Line of Credit

You can take funds from the credit account which will be considered against your balance as frequently as you desire, but permitted up to a defined limit. Monthly payments are required after borrowing from your line to payback the account balance. You are still able to borrow additional funds with an outstanding balance as long as you have not met the limit. Individual withdrawals have the same loan terms and is treated as a singular loan.

How does it work?

You can borrow up to the max limit of the business credit line you have been approved to use

You will only pay interest on the amount of funds drawn from the line of credit

You will be able to tap into the business credit as long as you don’t exceed the credit limit and succeed

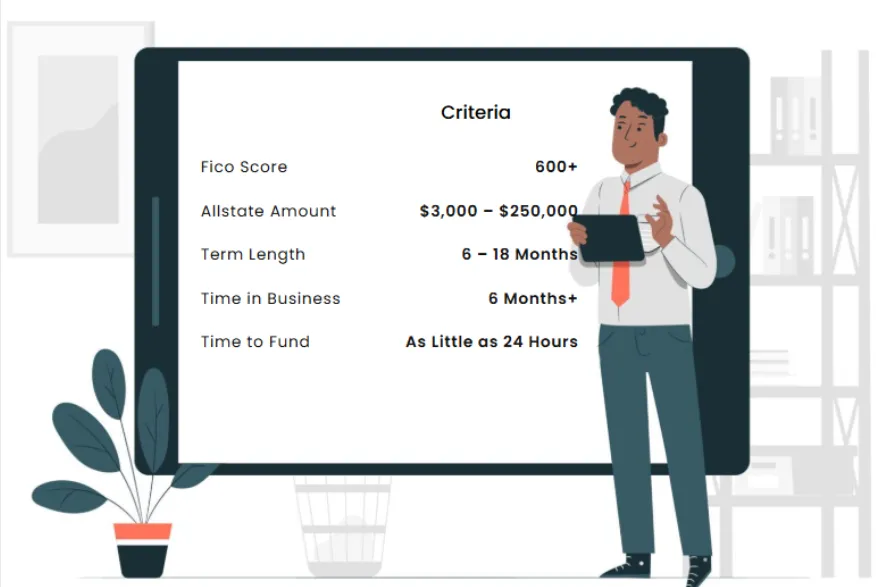

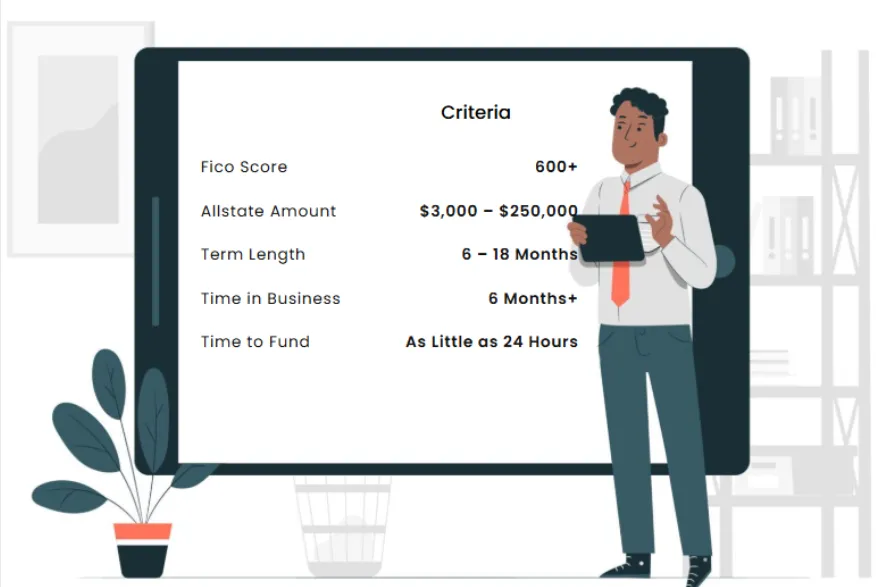

Get Premier Assistant

There is no obligations for trying and it never affects your credit score

Premier Assistant offers a variety of products over a wide range of industries to help grow your business. Contact us: (646)-759-2511

NEWSLETTER

Get Premier Assistant

There is no obligations for trying and it never affects your credit score

Premier Assistant offers a variety of products over a wide range of industries to help grow your business. Contact us: (646)-759-2511

NEWSLETTER